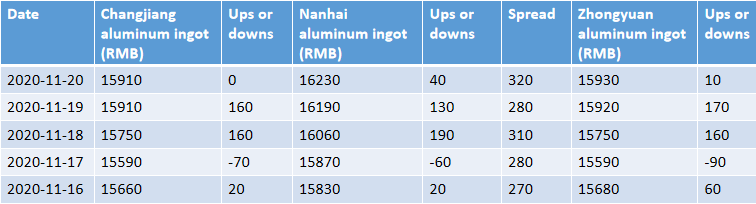

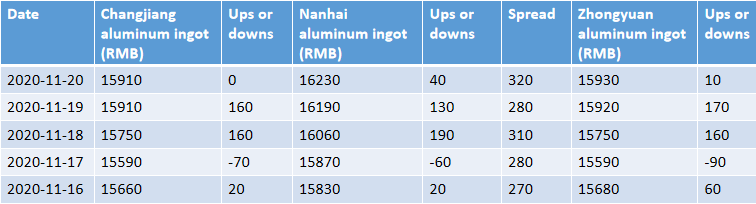

1. Spot prices of major domestic aluminum ingots in a week

This week, prices remained below 16,000, with active trading in the spot market, active shipments by stockholders, low purchases by intermediaries, and passive deliveries by downstream traders.

2. Weekly Highlights Review.

- U.S. new housing starts in October totaled 1.53 million, a 4.9% increase from the previous month and an estimate of 1.46 million, while the September value was revised to 1.459 million from 1.415 million, and the September increase was revised to 6.3% from 1.9%.

- U.S. initial jobless claims for the week of November 14 were 742,000, compared to expectations of 700,000 and the previous reading of 709,000. Continuing jobless claims for the week of November 7 were 6.372 million, compared to 6.4 million expected and 6.786 million previous.

- In October, power generation was 609.4 billion kWh, up 4.6% year-on-year, down 0.7% from last month; average daily power generation was 19.66 billion kWh, down 1.39 billion GWh. From January to October, power generation was 6,028.8 billion kWh, up 1.4% year-on-year.

3. Aluminum Ingot Price Analysis for Next Week.

This week, prices remained below 16,000, with active trading in the spot market, active shipments by stockholders, low purchases by intermediaries, and passive deliveries by downstream traders.

From the futures market point of view, the lun aluminum continue to recent gains, short-term facing turnover intensive resistance area, concerned about the 2000 regional price performance, Shanghai aluminum to maintain the medium-term rally, accelerate the pull up to 15700 near, concerned about the 15400-15800 range fluctuations.

Macroscopic global epidemic development rapidly, but at the same time the major pharmaceutical enterprises vaccine progress smoothly, the United States election is basically confirmed, the global central bank water to restore economic growth has become the current market consensus. Domestic good news, home appliances and automobiles to the countryside, fiscal policy easing policy, and so on good stack, non-ferrous metal overall demand is expected to improve substantially.

Industry fundamentals, midstream inventory continues to decline, supply and demand overall to maintain a tight balance. Futures plate to see the Shanghai Lun aluminum to maintain the long trend, continue to attack, but short-term signs of acceleration, and faces long-term important resistance band, attention to the multi-employee struggle. Next week, aluminum prices continue to hit 16000, for reference only.

Nancy He

huayangnancy@gyhyly.com

+86 18037312887